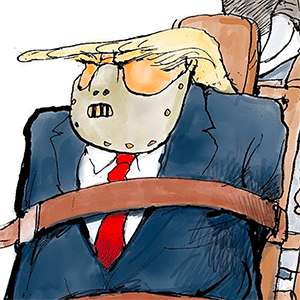

Editorial: The president loves to slap his name on things. Does he really want a 'Trumpcession'?

Published in Political News

Even before President Donald Trump started his trade wars, McDonald’s Corp. top brass knew this year would start sluggishly.

Prices are up for food, paper goods and labor, while many of the Chicago-based burger chain’s core customers are finding the menu unaffordable. As a result, CEO Chris Kempczinski told investors last month, “The overall market is pretty muted.”

It’s the same story for many American businesses, as quarterly financial reports will make obvious in the weeks ahead. CEO optimism has plunged since Trump’s tariff shocks, and consumer sentiment alarmingly has followed suit. A Bank of America survey shows that fund managers have slashed their holdings of U.S. stocks.

Last week, the U.S. Federal Reserve declined to cut interest rates, leaving them at high levels to fight the inflationary effect of Trump’s self-defeating trade policies. The Fed also cut its forecast for economic growth.

We’d like to think Trump will learn from the bad vibes and market volatility. His broad tariffs are akin to punishing taxes on American consumers, and his arbitrary attacks on close allies undermine a free market that helps keep prices down. As we’ve said before, Trump needs to listen to Americans, including many who voted for him, and cancel his economic reality show before it sinks the strong-ish economy he inherited from President Joe Biden.

Here’s the good news: The White House still has plenty of latitude to avoid a “Trumpcession.” And while sentiment has taken a dive, many business leaders are keeping the faith that Trumpian policies will work out in the long run.

All Trump needs to do, contrary to his penchant for sowing chaos, is to settle down and follow through on the more realistic promises he made during his campaign. The rotten start to his second term will be forgiven in corner offices if the president can deliver the tax cuts and hands-off regulatory policies that many business leaders were counting on when they supported him despite reservations about his odious personal history.

While Trump’s unqualified Cabinet nominees got more attention, he also has tapped experienced executives and hands-off regulators for powerful roles, marking a U-turn from a Biden team viewed as actively hostile to business. The upshot could be a much better environment in Washington for everything from global banks and cryptocurrency vendors to Big Pharma and technology giants.

Consider the current capital rules for banks, which tie up a fortune that otherwise could be deployed for growth instead of compliance with layer on layer of bureaucracy.

In 15 years since the Dodd-Frank Act, the rules have just kept coming from the Federal Reserve, Office of the Comptroller of the Currency, Federal Deposit Insurance Corp., Treasury Department and 50 state banking offices. Rationalizing those regulations could unleash hundreds of billions in investment dollars now shelved to meet redundant risk-management requirements.

Is Trump the man to do it? So far, no. But if he listens to the marketplace, maybe.

Similarly, the past decade has witnessed a boom in private investment that built companies of significant value. At the same time, heavy-handed regulation has raised the cost of initial public offerings and discouraged mergers and acquisitions, complicating exit strategies for those investors.

Other countries are making changes to encourage IPOs and reduce reporting requirements. Singapore, for instance, enables companies to report semiannually instead of quarterly, and Europe has started down that path as well. For smaller, newer public companies, especially, the result is reduced regulatory costs and more time to focus on business operations. As Loh Boon Chye, leader of Singapore’s SGX exchange, notes, “That’s better for companies and investors.”

Yet once again, Trump has made matters worse by sparking uncertainty and volatility in the financial markets, which discourages IPOs and dealmaking. Even with a new day dawning at the Securities and Exchange Commission, Federal Trade Commission and other agencies that were roadblocks during Biden’s era, the changes won’t matter unless market conditions settle down.

Are you listening, Mr. President?

One group is listening, for sure: America’s competitors abroad. It is disturbing to see China emerge as a more reliable global trade partner than the U.S. At the same time, Europe is being galvanized into unified action that has eluded it for years, greatly accelerating its previously weak attempts at deregulation, market integration and targeted fiscal spending.

While boycotts usually have little long-term effect, the short-term backlash against Trump’s aggression is going well beyond Elon Musk’s Tesla to other symbols of America. Multinationals like McDonald’s already face strong competitors such as A&W in Canada and Greggs in the United Kingdom poised to take advantage of anti-American sentiment.

McDonald’s is rolling out a “McValue” menu aimed at reducing sticker shock, teasing the launch of innovative new food items and praying, as its executives told Wall Street last month, that operating conditions gradually improve as the year rolls on.

President Trump, it’s time to stabilize the economy. The downside risks are rising. Let’s eliminate the threat of a “Trumpcession” before it’s too late.

___

©2025 Chicago Tribune. Visit at chicagotribune.com. Distributed by Tribune Content Agency, LLC.

Comments