Real Estate Matters: Heirs may lose family home after failing to pay taxes

Q: My mother left her home to her five children. Three of the children live in the home and have been there for six years. None of the kids living there have paid anything toward the real estate taxes for years. The house is now in foreclosure. My question is whether I can pay the back the real estate taxes that are due on the home, continue to pay those taxes and become the owner of the home sometime in the future.

A: The short answer is no. Your mother left the home to her kids. Each kid owns 20 percent of the home. They are all owners. You can’t simply take their ownership away by paying the taxes on the home. On the other hand, the children living in the home can’t take away your ownership interest in the home simply by living there.

There has to be more to the process to give a co-owner of the home the right to do something and get full ownership of the home. We will say that some states have laws in place that work to clean up messy titles and fix homes with disputed ownership claims. However, you and your siblings do not dispute that all of you own your share of the home. The real issue is that some of the siblings aren’t paying for the expense (real estate taxes) for the home.

On the foreclosure side, you didn’t mention if the lender on the home was foreclosing on the home or whether the taxing authorities had initiated that process. One way for you to become the owner of the home would be to allow the home to go through the foreclosure process and buy the home at the foreclosure sale. This is a risky process. A different buyer could outbid you and end up as the owner of the home and you’d be completely out of luck.

We have to assume that you and your siblings have discussed the fact that they aren’t contributing toward the real estate taxes. Are they paying other expenses, such as maintenance, upkeep, repairs, insurance or mortgage payments (if there are any)?

Depending on where things stand, you might want to talk to an attorney about your options. One option is to try to buy your siblings out, have them move out and take control of the home. If they were to agree, you’d become the sole owner of the home but would have to agree on a price for the home and pay them off. We don’t know what that amount would be, nor do we know if you have the financial ability to buy the home. But if you have the financial means, and they're willing, you might be able to make it happen.

You might also be able to force the sale of the home. That could be expensive, and may not be worth it unless you work through the numbers to see what the suit might cost you, how much equity is in the home and where you’d come out in the end.

Litigation would likely strain your family ties, because litigation generally does that. We suggest you have an honest conversation with your siblings about the home, its expenses and what will happen to the home through the foreclosure process. Perhaps they will be receptive and work with you to come up with a solution that meets with everyone’s approval.

Finally, tally up all of the expenses of the home since the five of you inherited it. Then add in who has paid for what. This way, you’ll have a record of how much each sibling has contributed to the home over the years. Consider it a conversation starter. If and when you do decide to buy out your siblings or sell the property, you’ll be able to figure out who gets what from the proceeds.

We feel for families like yours where there are some members that contribute and others that don’t. And we hope this situation resolves itself with your sibling relationships intact.

========

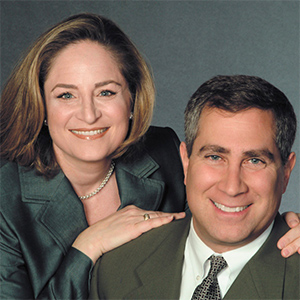

(Ilyce Glink is the author of “100 Questions Every First-Time Home Buyer Should Ask” (4th Edition). She is also the CEO of Best Money Moves, a financial wellness technology company. Samuel J. Tamkin is a Chicago-based real estate attorney. Contact Ilyce and Sam through her website, ThinkGlink.com.)

©2025 Ilyce R. Glink and Samuel J. Tamkin. Distributed by Tribune Content Agency, LLC.

Comments