Will quitclaim deed trigger reassessment of home value?

Q: My mom and I are on the title of a property that is almost paid off. She wants to take her name off the title using a quitclaim deed. Is the property going to get reassessed? And, is the property tax bill going to increase based on the current assessed value? Thank you.

A: You’ve raised an interesting question. The one thing you didn’t mention in your email is whether this home is either your mother’s primary home or your primary home. Let’s back up a bit and address the issue of how real estate taxes get determined in many parts of the country.

Your local taxing body generally determines the amount of real estate tax to levy using the value of the home. Once the value of the home is established by the taxing body, the owner may be entitled to certain limits on how much your real estate taxes can rise. Or, they may be entitled to reduce the tax bill based on certain benefits or exemptions they’re entitled to take or apply.

We won’t deal with reductions or exemptions in this column, but your question is about the process the local taxing body uses to determine the value of your home. In some locations, a taxing body will determine values of homes on a yearly basis. In others, they may determine the value of a home once every three or so years. And in other locations, they may wait until a property’s title is transferred to come up with a new value for the home.

The method the local taxing body uses to determine the value of a home can be extremely complicated. For your purposes, you need to know whether your local taxing body automatically updates the value for your home when there is a transfer of ownership. In many places, a change of ownership between family members, to place a home into a living trust or for estate planning purposes, won’t by itself trigger a reassessment for your home.

Before you retitle the property, call your local tax assessor or other taxing body responsible for determining the value for your home to see whether your transfer would trigger them to come up with a new value for your home. If it does, you can find out if that new valuation will result in a large increase in your real estate taxes.

Say your mom purchased the home decades ago, and the change of ownership to you triggers a reassessment of the home; you could see your taxes skyrocket. The local taxing authority’s determination of what your home is worth might be tied to the sales price of the home. If your sale will cause a big change in your tax bill, you might want to talk to an estate planning attorney now about whether placing the home in a living trust that names you as beneficiary is worthwhile.

There may be other options as well. So, take the time to fully investigate this issue now rather than wait until the next tax bill comes out.

========

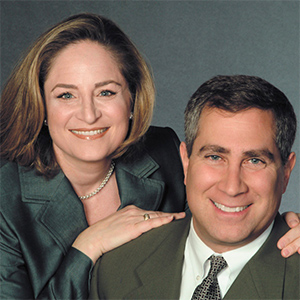

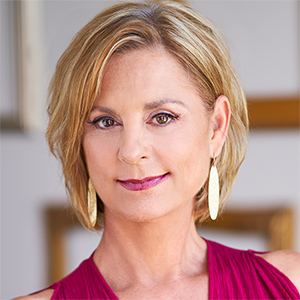

(Ilyce Glink is the author of “100 Questions Every First-Time Home Buyer Should Ask” (4th Edition). She is also the CEO of Best Money Moves, a financial wellness technology company. Samuel J. Tamkin is a Chicago-based real estate attorney. Contact Ilyce and Sam through her website, ThinkGlink.com.)

©2025 Ilyce R. Glink and Samuel J. Tamkin. Distributed by Tribune Content Agency, LLC.

Comments