Ready to Cash Out, But Dad Still Owes You? Read This

Reader Question: I live in Colorado but still own a house in New Hampshire. Years ago, I let my father refinance it; a friend now lives there. I want to sell the property myself. How do I be sure my dad's loan gets paid off at closing, and how should I handle my friend? My dad has the payment records, but can't find the file.

Monty's Answer: Three jobs overlap: clearing the title, settling the loan, and retaking possession. If you walk through them in that order, the rest will fall into place.

No. 1: Verify the Paperwork

-- Order a current title report from a New Hampshire title or escrow company; it lists every recorded lien, judgment, or restriction.

-- Ask the lender for a payoff quote, which is good through closing, and copies of the note and mortgage, so you know the exact balance and any fees.

-- If the debt is between you and Dad, formalize a promissory note stating today's balance and that it will be paid from the sale proceeds. Putting terms in writing now prevents closing-day misunderstandings.

No. 2: Talk With Dad Right Now

Show him the payoff figure and your timeline. Explain that the title company will wire his payoff straight from the sale proceeds, so neither of you handles a check. This transparency heads off most family stress.

No. 3: Clarify Your Friend's Status

Is rent paid? If so, lease terms control notice. If not, New Hampshire treats the occupant as "at-will," requiring 30 days' written notice. Start the clock today and consider cash-for-keys if you want possession sooner; small incentives often save weeks.

No. 4: Choose a Remote-Friendly Sale Path

Because you're in Colorado, pick a New Hampshire title company that offers remote online notarization (RON) so you can sign from home. Use a flat-fee MLS plus a transaction coordinator and keep the commission spread among yourself. Interview at least three agents to get a sense of value and the overall market. One may persuade you to employ them.

No. 5: Price and Prep to Today's Market

Skip guesswork: review recent comparable sales on each agent's report. This action will help you determine which agent is closest. Order a pre-listing inspection; disclose defects up front and offer a repair credit at closing so buyers handle repairs. A clean, easy-to-tour home, vacant by closing, earns top dollar.

No. 6: Let the Closing Company Run the Money

At closing, the escrow officer collects the buyer's funds, pays off every lien, including Dad's note, deducts fees and wires you the net. Escrow math turns promises into cash.

Why This Sequence Matters

Buyers and lenders only consider three answers: Is the home defect-free? Is the price fair? Can I occupy at closing? Solve those before you list, and you will avoid eleventh-hour renegotiations that erode price.

Action Checklist

-- Order title search and payoff quote this week.

-- Draft or confirm Dad's promissory note.

-- Serve notice (or cash-for-keys) to your friend.

-- Choose your selling path and sign RON-ready paperwork.

-- Finish repairs, cleaning, and photography.

-- Launch marketing once access and possession dates are firm.

With a clear roadmap, you'll sell efficiently, without ceding control to a system built for agents, not owners. Early transparency saves money, builds trust and family harmony.

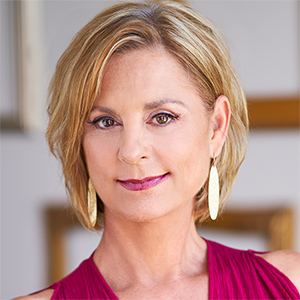

Richard Montgomery is a nationally syndicated columnist, published author, retired real estate executive, serial entrepreneur, and the founder of DearMonty.com. He provides consumers with free options to pressing real estate issues. Find him on Twitter(X) @dearmonty or DearMonty.com.

----

Copyright 2025 Creators Syndicate, Inc.

Comments