After Warner defeat, Comcast loads up on Winter Olympics, Super Bowl and NBA

Published in Entertainment News

LOS ANGELES — Shaking off its defeat in the Warner Bros. bidding war, Comcast is focusing on its big sports bet.

NBCUniversal will broadcast the Winter Olympics, Super Bowl, NBA, Major League Baseball and the World Cup this year.

The Philadelphia giant released its fourth-quarter earnings Thursday and its sports-heavy strategy is revealing both the benefits and costs. NBCUniversal's new NBA deal has had the hoped-for effect of boosting subscribers to its Peacock streaming service.

Peacock now has 44 million customers and streaming revenue grew 23% to $1.6 billion. But Peacock's losses swelled to $552 million in the fourth quarter as the streaming service absorbed the expense of NBC's NBA TV rights agreement and an exclusive NFL game.

Comcast executives said during an earnings call that Peacock reduced its full-year losses by $700 million compared to 2024. Last year, the service lost $1.1 billion and profitability is still a ways off.

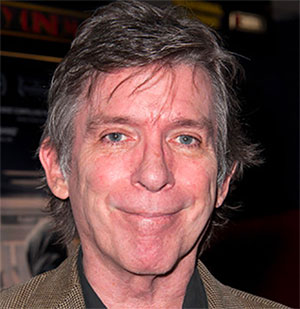

Comcast Chairman Brian Roberts noted that the entertainment industry is in the throes of a major transformation and that NBCUniversal has laid the groundwork for its own metamorphosis. His company has made a sharp pivot away from NBC's 1990s glory days of "Must-See TV" comedies, water-cooler dramas like "ER" and "West Wing," as well as a fleet of formidable cable channels, including USA and CNBC.

This month, the cable channels were spun off into a new company called Versant.

Comcast entered last fall's high-stakes Warner auction with hopes of combining NBCUniversal with Warner Bros. to create a new Hollywood behemoth. But Netflix swooped in with a $82.7 billion deal and David Ellison's Paramount Skydance also made an all-cash bid. Paramount has refused to accept defeat, launching a hostile takeover to attempt to claim its rival — a pursuit that Warner board members are fighting.

"In terms of Warner Bros., what can you say?" Roberts said. "It's still underway, obviously."

Marrying NBCUniversal and Warner Bros. would have made a compelling company, Roberts said. But as soon as its competitors turned to all-cash offers, "We were just not interested in these values, stretching our balance sheet to do something like that," he said.

The longtime cable chief pointed to the silver lining.

Preparing its bid for Warner Bros. "forced us on the journey to really take a good look at what we have and what we're building," Roberts said. "We have a wonderful studios business ... 2026 should be a great year for the film business. ... We have two studios in the television business, which is feeding Peacock."

NBCUniversal is moving closer to its goal of becoming "an integrated media business that is profitable and [has] got a lot of sports," a streaming service and Universal theme parks, Roberts said, adding the Warner auction has prompted other firms to discuss possible combinations.

NBC, which turns 100 this year, has long carried live sports.

But it has doubled down and February will be packed with the Winter Olympics in Italy, the Super Bowl near San Francisco and the NBA All-Star game in Inglewood.

In March, NBC and Peacock will begin broadcasting MLB games, including the Dodgers hosting the Arizona Diamondbacks on opening day.

The company's Spanish-language network Telemundo will broadcast the World Cup this summer, including a stop in Los Angeles.

"We're very confident and comfortable that we're in the right part of the industry," Roberts said. "We hope the Olympic Games can offer a moment of connection for our country and for people everywhere" during such divisive times, he said.

Comcast has been struggling in its core broadband business as cellphone carriers with 5G service have cut into its former dominance. Millions of customers have ditched their cable TV packages.

The company switched up management in Philadelphia in October, installing Steve Croney as chief executive of its connectivity and platforms business. And Comcast has trimmed some of its internet package prices to better compete.

In the fourth quarter, Comcast lost 181,000 domestic broadband customers — more than what analysts had forecast. The company said some of the losses were offset by gaining international customers.

Comcast generated quarterly revenue of $32.3 billion, a slight increase that was in-line with expectations. Adjusted earnings a share decreased 12% to 84 cents, higher than expected.

Net income attributed to Comcast came in at $2.2 billion, which was more than 50% lower than the year-earlier period. The decline reflected a tough comparison to the prior year period, which included a $1.9 billion income tax benefit attributed to an internal corporate reorganization.

NBCUniversal produced $12.7 billion in revenue, a 5.4% increase.

The media unit, which includes television and streaming, contributed $7.6 billion in revenue, a 5.5% gain. (The numbers included results from the profitable cable channels, which became a separate entity on Jan. 2.) Higher advertising sales and Peacock, which began carrying the NBA, helped deliver the gains. Peacock recently raised its monthly fee.

But media earnings before interest, taxes, depreciation and amortization tumbled 141% to a loss of $122 million to account for the NBA contract.

Theme parks, which now boast Universal's Epic Universe near Orlando, Florida, produced $2.9 billion in revenue — a 22% increase. It generated $1 billion in profit.

NBCUniversal's studio business generated $3 billion in revenue, a decline of 7.4%. It notched $351 million in earnings, a decline of 38%.

Although shut out of the Oscar nominations, Universal Pictures' "Wicked: For Good" fetched $1.3 billion in global ticket sales.

Comcast shares were up 4.3% to $29.63 in midday trading.

©2026 Los Angeles Times. Visit latimes.com. Distributed by Tribune Content Agency, LLC.

Comments