Giving the gift of a college savings plan

The upcoming holiday gifting season is a perfect time to review the incredible 529 college savings plan opportunity to build a tax-free fund for college, which can be used by any member of your family. And with recent improvements, even if your child gets a scholarship or decides not to attend college, the money can continue growing for other children in the family, or even as a Roth IRA rollover.

Congress created the 529 college savings plan in 1996, named after the section of the IRS code that governs it. In nearly 30 years, over 12 million families have saved more than $258 billion in tax-free money used for college expenses, according to CollegeSavings.org.

So, here’s a reminder of how easy it is to set up a 529 college savings plan for a child or grandchild, and why you should encourage gifts to the plan for birthdays and special events.

Money in a 529 plan grows tax free for a wide variety of education expenses, including college tuition, room and board and most fees. The money can be used for any college in any state. Since 2018 these funds can also be used for K-12 education expenses.

There is no federal tax deduction for gifts to a 529 plan, but many states do allow a limited deduction from state income taxes for your gifts. For example, Illinois allows a deduction for up to $10,000 of contributions in any one year.

The estate exemption for gifts in 2024 is $18,000, so if grandparents are feeling generous they can get that money out of their estate by putting it into a 529 plan — one for each grandchild! The truly wealthy can fund five years of the exemption at one time — a combined $90,000 at once — from each grandparent.

But don’t be intimidated. Most 529 plan accounts are opened with a few hundred dollars, and will accept additional contributions of as little as $25 at a time, from anyone who wants to contribute. And a 529 plan will have minimal impact on financial aid, certainly far less than money held in a custodial account.

This is a do-it-yourself project, although many brokers and financial advisers do sell the plans. But why pay those extra fees? You can open an account directly at the website of the plan you choose, and still receive statements of your investment performance by mail.

Each state sets up its own plan, using its own advisers and creating its own investment options. Since you can use any state’s plan (aside from the potential state tax benefits), it pays to do a little research. Fortunately, Morningstar ranks each plan every year from the top-rated gold ranking, down through silver and bronze to neutral and negative.

The latest results were reported on November 1. The five gold ranked plans are: Alaska, Illinois, Massachusetts, Pennsylvania and Utah. But look carefully, because in several cases only the direct-sold (not broker-sold) plan gets the gold rating! For a complete list of the latest Morningstar ratings, read "Morningstar 529 Ratings: The Best 529 Plans of 2024."

To get started you’ll need a Social Security number for the child. Either a parent or grandparent can be the custodian of the child for the purposes of naming the plan. And any friend or relative can contribute money at any time. Also, the money can eventually be used by any child in the family.

Each plan offers its own menu of investment choices. Most offer an “age-based” plan, where you give the child’s birth date, and depending on the age (and number of years to college needs), the plan starts out investing more aggressively and becomes more conservative in later years.

You might want to become much more conservative in the year or two before college, by moving most of the money into a money fund alternative within the plan.

Note: Some states offer both an “investment” plan and a prepaid tuition plan. But prepaid tuition plans typically limit choices to in-state schools or offer reduced payouts if an out-of-state college is chosen. Even worse, ultimate payouts may depend on availability of state funds.

If your child gets a scholarship or decides not to attend college, the most recent revisions allow 529 money, in the account for at least 15 years, to be converted into a Roth IRA, once the child starts working. A maximum of $35,000 can be rolled, subject to annual income and contribution limits.

Escaping taxes and building a college fund are the perfect combination in a 529 plan. And that’s The Savage Truth.

========

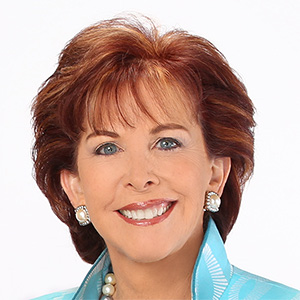

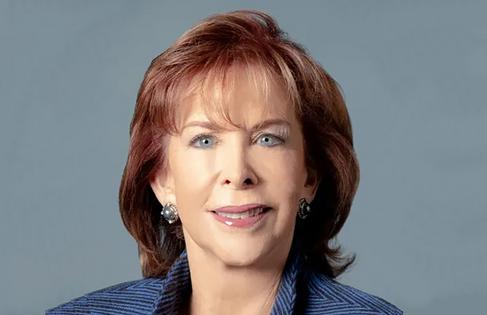

(Terry Savage is a registered investment adviser and the author of four best-selling books, including “The Savage Truth on Money.” Terry responds to questions on her blog at TerrySavage.com.)

©2024 Terry Savage. Distributed by Tribune Content Agency, LLC.

Comments