Netflix agrees to buy Warner Bros. in a $72 billion deal that will transform Hollywood

Published in Business News

LOS ANGELES — First, Netflix upended Hollywood. Now, the streaming giant is buying a historic piece of it.

Netflix prevailed in a contentious bidding war to buy Warner Bros., agreeing to pay $72 billion for the storied Burbank film and television studios, its spacious lot, HBO and the HBO Max streaming service.

The two companies announced the blockbuster deal early Friday, a proposed baton pass that would give Netflix such beloved characters as Batman, Harry Potter, Jon Snow and Fred Flintstone.

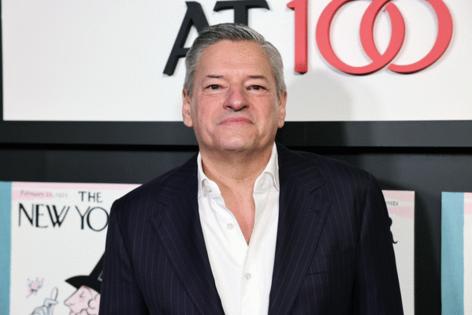

“Warner Bros. has some of the best entertainment in the world,” Netflix Co-Chief Executive Ted Sarandos said during a conference call with Wall Street analysts. “The combination of Netflix and Warner Bros. creates a better Netflix for the long term. It sets us up for success for decades to come.”

Netflix’s cash and stock transaction is valued at about $27.75 per Warner Bros. Discovery share. Netflix also agreed to take on more than $10 billion in Warner Bros. debt, pushing the deal’s enterprise value to $82.7 billion.

Buying a studio that dates back 102 years to the silent picture era represents a major strategic shift for the Los Gatos, Calif. firm. Netflix sputtered to life in 1997 by buying movie DVDs and mailing them in red envelopes to customers.

While Netflix has delivered some successful TV francishes along the way — including “Stranger Things,” “Squid Games,” “Bridgerton,” “KPop Demon Hunters,” — the streamer does not have a deep library. And that’s what this deal represents.

“This move is all about adding serious firepower to Netflix’s content game,” said Julie Clark, senior vice president of media and entertainment at information firm TransUnion.

“HBO brings a treasure trove of IP, proven franchises, and world-class storytelling,” she said. “That’s huge for Netflix..”

The deal suggests Netflix executives recognized the company’s steady growth could stall unless it stepped up production of new hit shows.

“Warner Bros. ... has got extensive studio assets ... including a leading television studio,” Netflix Co-Chief Executive Greg Peters said during the call. “This acquisition will allow us to significantly expand our production capacity in the United States and keep investing in original content. Over the long term, that means more opportunities for creative talent.”

Until this week, few expected Netflix to win the auction.

Netflix executives have long down-played merger talk, including as recently as two months ago when Peters said during a Bloomberg conference that Netflix’s heritage was “being builders rather than buyers.”

Instead, Paramount, controlled by the billionaire Larry Ellison family, was widely seen as the likely buyer after it launched the bidding for all of Warner Bros. Discovery in September. But Warner’s board rejected Paramount’s series of offers as too low. The company opened the auction to other prospective suitors in late October.

The breakthrough came earlier this week, after the three contenders — Netflix, Paramount and Comcast — submitted their second-round proposals. Netflix’s staggering largely cash offer was too rich for the others to beat.

Netflix and Warner Bros. said their boards had separately and unanimously approved the transaction.

The deal is subject to approval by Warner shareholders and government regulators in the U.S. and abroad. Netflix said it should be able to finalize the purchase in about a year to 18 months.

Warner’s cable channels, including CNN, TNT and HGTV, are not included in the deal. They will form a new publicly traded company, Discovery Global, in mid-2026. Warner Chief Executive Officer David Zaslav will continue to manage the business through its cable channel spin-off until the close of Netflix’s takeover of the studio assets.

In the past decade, Netflix has boot-strapped its way to becoming a global behemoth by challenging the Hollywood establishment and its longstanding business model of releasing movies in theaters — months before they debuted in the home. Netflix also defied conventions by releasing an entire season of TV episodes in one drop, eschewing the tradition of parceling out a new episode each week.

Netflix has more than 300 million streaming subscribers worldwide, and with HBO Max, the company’s base would swell to more than 420 million subscribers — far more than other premium video-on-demand streaming services.

The purchase reveals that Netflix executives may have had concern that the company’s steady growth might eventually stall, unless it stepped up production of new original shows.

“Warner Bros. ... has got extensive studio assets ... including a leading television studio,” Peters said Friday. “This acquisition will allow us to significantly expand our production capacity in the United States and keep investing in original content. Over the long term, that means more opportunities for creative talent.”

Anti-trust experts have said they anticipate opposition to Netflix’s proposed takeover.

“There is very little consumer upside to be gained from letting the clear Number One player in the streaming market buy a major competitor,” TD Cowen media analyst Doug Creutz wrote Friday in a note to investors. “And ... there could be significant consumer downside.”

The deal poses “an unprecedented threat to the global exhibition business,” Cinema United, a trade group representing owners of more than 50,000 movie screens, said in a statement announcing its opposition.

“The negative impact of this acquisition will impact theatres from the biggest circuits to one-screen independents in small towns in the United States and around the world,” said Cinema United President Michael O’Leary in a statement. “Netflix’s stated business model does not support theatrical exhibition.”

Netflix, in the statement, said it would maintain Warner Bros. and HBO’s operations, including theatrical releases for Warner Bros. films. During the bidding process, Netflix assured Warner executives that it would honor Warner Bros.’ existing commitments to release its films in theaters.

Netflix, in the past, has shown a preference for simultaneous releases, sparking tensions with cinema chains. One lingering question, analysts say, is how Netflix will approach theatrical distribution over the long haul.

Netflix agreed that it would pay a $5.8-billion termination fee if the deal fails to clear the regulatory hurdles.

“We’re really confident that we’re going to to get all the necessary approvals that we need,” Sarandos said. “We are running full-speed toward getting regulatory approval.”

If Warner Bros. Discovery walks away, it would have to pay Netflix a $2.8 billion break-up fee.

In a joint statement, the Writers Guild of America’s east and west chapters blasted the deal, saying “the world’s largest streaming company swallowing one of its biggest competitors is what antitrust laws were designed to prevent. The outcome would eliminate jobs, push down wages, worsen conditions for all entertainment workers.”

“Industry workers along with the public are already impacted by only a few powerful companies maintaining tight control over what consumers can watch on television, on streaming, and in theaters. This merger must be blocked,” the statement read.

Losing the auction is a crushing blow for Paramount’s David Ellison, the 42-year-old tech scion who envisioned building a juggernaut by uniting two storied movie studios, two dozen cable channels and HBO.

Ellison’s Skydance Media, with backing from his father Larry Ellison, in August closed its purchase of Paramount, which gave him the Melrose Avenue movie studio, CBS broadcast network, Comedy Central, BET and Nickelodeon.

A month after buying Paramount, the Ellisons set their sights on Warner Bros., triggering the auction with a series of unsolicited and failed bids in September and early October.

Comcast also leaped into the bidding for Warner’s studios and HBO. Comcast had proposed spinning off its NBCUniversal media assets to merge with Warner Bros. to form a jumbo traditional entertainment company.

Earlier this week, the auction took a bitter turn as Paramount saw the assets slipping away.

Paramount accused Warner Bros. Discovery of tilting the field to favor Netflix in a letter to Zaslav. Paramount’s lawyers wrote: “Paramount has a credible basis to believe that the sales process has been tainted.”

Warner denied that the process was unfair. But it was unclear Friday whether Paramount would continue to press its case.

____

©2025 Los Angeles Times. Visit at latimes.com. Distributed by Tribune Content Agency, LLC.

Comments