Senate stablecoin bill trips on cloture vote

Published in Political News

WASHINGTON — The Senate didn’t muster enough votes to carry a stablecoin bill across a procedural hurdle Thursday, leaving in limbo a bill that only two months ago found bipartisan support in the Senate Banking Committee.

The 48-49 cloture vote on whether to proceed to the bill came after Democrats decided that bill sponsor Bill Hagerty, R-Tenn., didn’t go far enough to satisfy them in the revised bill he released on May 1.

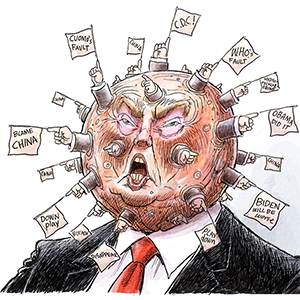

Democrats also objected to the bill’s silence on President Donald Trump and his family’s involvement in several stablecoin issuances. Stablecoins are digital currencies pegged to a reserve asset such as the dollar.

Senate Majority Leader John Thune, R-S.D., appeared to offer an olive branch Wednesday when he started the process to put a separate bill from Jeff Merkley, D-Ore., on the floor agenda. Merkley’s bill would prohibit the president, vice president, members of Congress and Senate-confirmed appointees from issuing, sponsoring or endorsing certain financial instruments.

Thune also said on the floor Thursday that he would be open to amendments on Hagerty’s bill after the cloture vote.

“Once we are on the bill, we can discuss changes here on the floor. We’ve had an open process on this bill so far, so why stop now?” he said.

But the effort wasn’t enough to get the Senate to the 60 votes needed to invoke cloture. Thune changed his vote to “no,” a move that gives him the right to reintroduce it. He also immediately made a motion to reconsider the vote.

“Not every bill that comes to the floor is a final bill,” Thune said. “The floor is where every senator gets a chance to give his or her input.”

Sen. Ruben Gallego, D-Ariz., a supporter of the bill in committee who said last weekend he would vote against it on the floor, asked for unanimous consent to move the vote to May 12. Sen. Elizabeth Warren, D-Mass., objected.

“We’ve made some great progress across the past week,” Gallego said. “We need time both to educate our colleagues and people. We want to bring this innovation to the United States. I’m asking for that time.”

Gallego told reporters that about 10 Republicans also objected to delaying the vote. He said only 10 minutes before the vote, senators were still talking.

“The reason this is going down is because Republicans didn’t give us enough time,” he said.

Democrats gave Hagerty’s bill five votes when the committee approved it in March. But four of those Democrats joined a statement last weekend saying the revised bill didn’t go far enough and they would oppose it on the floor. Five other Democrats also joined that statement.

Thune’s proposal to give it floor time as the Senate prepared to vote on advancing Hagerty’s bill could have put Democrats in the position of helping get the Hagerty bill past a 60-vote cloture threshold, but then vulnerable to Republican solidarity on amendments and on passage itself, where a simple majority would prevail.

Supporters of the Hagerty bill, along with a similar measure approved April 2 by the House Financial Services Committee, say it would provide clear rules for issuing and regulating stablecoins.

The legislation would require issuers to maintain liquid reserves of safe investments such as U.S. Treasury debt, insured deposits and overnight Treasury repurchase agreements. Depending on the nature of the issuer, the regulator could be a federal or state supervisory agency.

“We have incorporated feedback from both Democrats and Republicans,” Sen. Cynthia Lummis, R-Wyo., said on the floor ahead of the vote. “We can begin the bipartisan proposal and move it one step closer to becoming law.”

Hagerty also took to the floor to urge support. He said he made changes since the Senate Banking Committee vote. “For us to even begin to implement these changes, we’re going to have to get on this bill,” he said.

“What we’re voting on is cloture,” Hagerty said. “It’s the beginning of debate for a bill that fundamentally supports cryptotechnology and innovation.”

Lummis, who has a reputation as a supporter of cryptocurrencies, told reporters that objections to the vote were short-sighted.

“This is a trillion-dollar-plus industry that they’re messing with,” she said. “We offered them the moon and then some,” Lummis said.

Senate Banking Chair Tim Scott, R-S.C., called the Democrats’ opposition “a disappointing display of political gamesmanship that puts partisan politics above a policy and obstruction above innovation.”

Trump family interests

Warren, who opposed the bill in committee, took to the Senate floor Monday to criticize it.

“When the bill advanced out of the committee, Democrats made clear they needed to see real changes to the bill before they could vote for it on the floor,” Warren said. “Democrats want to work with Republicans to advance a stablecoin bill that will make stablecoins safer to use and curb the worst abuses of the industry.”

Her floor speech called for revisions in five areas: rules to prevent government officials “to line their own pockets;” to prevent Big Tech and other commercial firms from issuing stablecoins; to add consumer protections; to safeguard national security with the same guardrails on stablecoins as are on other payment systems; and to ensure “a stablecoin meltdown won’t trigger an economy-wide financial meltdown.”

She also noted reports about Trump’s role in stablecoins.

“Since the committee vote, President Trump’s aggressive efforts to profit from stablecoins and the obvious opportunities for bribery and other influence peddling have demonstrated why it is vital that we make meaningful, substantive reforms to the bill,” she said. “Trump has created the opportunity to trade presidential favors like tariff exemptions, pardons, and government appointments for crypto purchases that will directly benefit himself and his family.”

Merkley has 18 Democratic co-sponsors for his bill that would put restrictions on executive branch officials and lawmakers’ involvement in stablecoins.

Sen. John Kennedy, R-La., said Thursday that the changes made since Hagerty’s bill came out of committee satisfied his initial objections.

“There were some changes made with respect to the difference between a domestic issuer and a foreign issuer, but I thought for the most part, well, for every part, the bill was strengthened,” he said.

Sen. Josh Hawley, R-Mo., voted against cloture as did Sen. Rand Paul, R-Ky.

Hawley said the bill didn’t include language to prevent Big Tech companies from issuing a stablecoin.

“I don’t want them using that to track even further everything that we do. They’re already tracking us too much. I don’t want them tracking our digital transactions,” he said.

_____

©2025 CQ-Roll Call, Inc., All Rights Reserved. Visit cqrollcall.com. Distributed by Tribune Content Agency, LLC.

Comments