COUNTERPOINT: The rich need to pay more taxes

Published in Op Eds

The share of before-tax income going to the richest 1% of taxpayers has more than doubled in the last half-century. This massive upward redistribution of income was primarily a result of the ability of the rich to structure the economy in ways that benefited them: trade agreements, longer and stronger patent monopolies, and a hugely bloated financial industry.

This was not enough for the nation’s rich. The wealthiest also demanded that politicians give them lower tax rates. And the politicians have responded to this demand from their wealthy campaign contributors.

The top tax rate faced by very high-income people fell from 70% in the 1970s to 35% today. The tax rate on capital gains, which accounts for most of the income of the rich and super-rich, is now 20%. The tax rate on corporate profits fell from 50% in the 1970s to 21% today.

That may sound bad for those concerned about fair taxes, but it worsens. Elon Musk and his DOGE crew have fired thousands of workers at the Internal Revenue Service. They have focused on the auditors — the people who make sure the wealthy and large corporations pay the taxes they owe.

Most of us have little choice in paying our taxes; they are deducted from our paychecks. But this is not the case with the rich and corporations. They must report their income and profits to the IRS and then calculate the taxes they owe.

The auditors at the IRS reviewed these tax forms and ensured the wealthy weren’t cheating the government. Musk’s firings essentially told the rich that there was no longer a cop on the beat. If the wealthy and big corporations don’t feel like paying their taxes, to a large extent, they no longer have to.

Incredibly, we are making the situation even more unfair with the massive taxes on imports that President Donald Trump announced this month (he prefers to call them tariffs). While Trump announced a pause on most tariffs Wednesday, we may be looking at a tax increase of close to $1 trillion annually. On average, this would come to more than $7,000 per household, and the burden would fall disproportionately on moderate-income and middle-income families rather than the rich. This is because the rich typically don’t spend all their income, and they spend more on services like restaurants and travel, which will be less affected by Trump’s tax hikes on imported goods.

This is the most anti-worker tax policy the United States has ever seen. In effect, the government is penalizing the people left behind in the last half-century.

It doesn’t need to be this way. There is plenty of room to raise taxes on the big winners in this economy. The United States saw the most rapid wage and income growth in the quarter century after World War II when the top tax rate for the rich was between 70% and 90%. Growth was also rapid in the 1990s when President Bill Clinton raised the top tax rate from 31% to 39%. Higher taxes on the wealthy have not kept the economy from growing.

We also need to make sure the wealthy and large corporations pay the taxes they owe. This means hiring back all the people at the IRS who Musk fired and probably a few more.

We can also ensure that we collect the corporate taxes we intend by making the basis of the corporate tax stock price appreciation rather than profits. Companies can lie about their profits, but they can’t hide how much their stock rose.

Higher taxes on rich people will also make it more difficult for the rich to buy elections. People with fortunes in the tens or hundreds of billions of dollars can single-handedly make even the most incompetent politician into a credible candidate. Preserving democracy is another good reason for raising taxes on the rich.

____

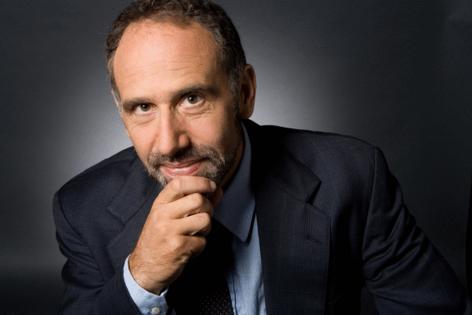

ABOUT THE WRITER

Dean Baker is a senior economist at the Center for Economic and Policy Research. He wrote this for InsideSources.com.

___

©2025 Tribune Content Agency, LLC

Comments