Nvidia is the first $4-trillion company. Here are three things to know

Published in Science & Technology News

Nvidia is already the world's most valuable company being one of the biggest beneficiaries of the global artificial intelligence boom.

This week, the Santa Clara, California-based chip maker got another windfall.

The Jensen Huang-led technology giant on Monday received approval from the U.S. government to sell some of its AI chips in China, boosting Nvidia's stock price by 4% to $170.70 a share on Tuesday. Rival Advanced Micro Devices Inc. has received similar assurances from the government.

Nvidia's valuation has risen dramatically over the last two years since generative artificial intelligence became a mainstream topic. Last week, the 32-year-old company became the first publicly traded firm to reach $4 trillion in market capitalization, beating tech titans including Microsoft and Apple.

Though it's a largely symbolic moment, the milestone raised the stakes for competition in the AI space, which has attracted enormous amounts of capital from established tech players and start-up investors.

"Once you reach that level of market cap, everybody and their brother wants to be you," said Rob Enderle, principal analyst with advisory services firm Enderle Group. "So that means that there's going to be a huge focus on creating competitive technologies to Nvidia because it looks incredibly lucrative."

Nvidia has become a primary force in the growth of AI technology, as many applications are built with Nvidia's chips.

Prior to the AI boom, Nvidia was mostly known for creating premium graphics cards that were attractive to gamers in rendering high-speed visuals. Most recently, the company is known for selling powerful chips that help chatbots such as OpenAI's ChatGPT and self-driving cars process information quickly enough to make the technology useful. Nvidia said in its 2025 annual report that it powers more than 75% of the supercomputers on the TOP500 list, which ranks the 500 most powerful computer systems in the world.

What is powering Nvidia's rise?

Founded in 1993, Nvidia has ridden many technology waves, including the crypto frenzy.

But lately, Nvidia has seen tremendous growth thanks to worldwide investor interest — and competition for dominance — in artificial intelligence.

Companies are eager to explore how AI can make processes more efficient and figure out complex problems. But getting the computing power behind AI can be expensive if companies are building hardware on their own. That's where Nvidia comes in.

Nvidia's sales increased 69% to $44.1 billion in its fiscal first quarter compared to a year ago. Net income was nearly $18.8 billion, up 26% from a year ago. In its fiscal year 2025, the company's revenue more than doubled to about $130.5 billion compared to a year earlier, and net income increased 145% to nearly $72.9 billion compared to fiscal year 2024.

In the last 12 months, Nvidia's shares have increased more than 30%. Since five years ago, the stock has risen more than 16-fold.

"It is clear AI is going to change the world and people want to get on that train, and Nvidia is the easiest entry point," wrote Berna Barshay, a partner at online investment platform Wall Street Beats, in an email. Over time, new winners and formidable rivals may emerge, Barshay said. "But during this foundational period of infrastructure creation, Nvidia has certainly been king."

Other companies were slower to innovate in AI, including Apple and Intel, and underestimated how quickly AI technology would advance, analysts said.

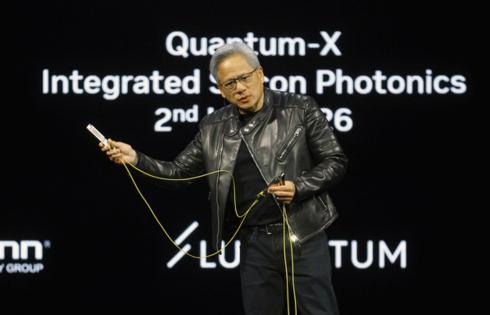

Who is Jensen Huang?

Huang, a former microprocessor designer, discussed the idea behind Nvidia inside a Denny's in San Jose with fellow entrepreneurs Chris Malachowsky and Curtis Priem. The company's name is partly based on the Latin word "invidia" — which means envy, according to the Wall Street Journal.

Many businesses are certainly jealous of Nvidia's success now, but in the 1990s, the company almost went out of business when its first chip, NV1, failed, according to media reports. Huang has said in public comments, including commencement speeches, that adversity can help people become better leaders.

Born in Tainan, Taiwan, in 1963, the onetime Denny's dishwasher has become one of the industry's most recognizable names, on par with Apple chief Tim Cook and Meta's Mark Zuckerberg. Thousands of people watch Huang's keynote at Nvidia's developer conference, as his vision could provide a road map for companies eager to expand investments in AI. Some analysts regularly refer to him as the "godfather of AI."

What challenges lie ahead?

The biggest challenges facing Nvidia are trade wars and competition, analysts say.

Tariffs in the semiconductor industry could hurt companies like Nvidia, which manufacture and sell countless chips abroad. The company said in its annual report that 53% of its revenue in its 2025 fiscal year came from outside the U.S.

The company said that worldwide geopolitical tensions and conflicts in countries like China, Hong Kong, Israel, Korea and Taiwan, where the manufacturing of its product components and final assembly are concentrated, could disrupt its operations, product demand and profitability.

Nvidia has worked with its production partners to increase U.S. manufacturing of its chips.

Several years ago, the U.S. restricted Nvidia's sales of its chips in China due to concerns that its AI technology could be used to help the Chinese military. Huang has said that since the U.S. government could choose to apply restrictions, he didn't think policymakers needed to be concerned about that and warned that allowing Nvidia to lose market share in China would cede a major advantage to Chinese tech company Huawei, according to Bloomberg.

While many analysts say Nvidia has a significant lead on competitors, it is possible over time they could catch up. OpenAI, which uses Nvidia products for ChatGPT, is developing its own chip design, according to Reuters.

There's also the question of whether the power grid is robust enough to support the infrastructure needs of the fast-growing technology, which could slow down not just Nvidia but the larger AI ecosystem.

Despite the challenges, Thomas Monteiro, senior analyst at Investing.com, is bullish on Nvidia, saying it is possible that the company could reach $5 trillion in market cap during the next 18 months.

"The world's still catching up and the thing is, it's going to take years for them to catch up," he said. "As long as we're looking at the AI revolution as a multidecade transformation, it's going to be really hard to take Nvidia out of that position."

©2025 Los Angeles Times. Visit at latimes.com. Distributed by Tribune Content Agency, LLC.

Comments