How to get your mortgaged home into a trust

Q: I created a trust so my three kids won’t have to deal with probate when I die, as I did with my parents’ home. How do I get my mortgaged home into the trust, or does it need to be?

A: We think you’ve made a good decision, one that your kids will thank you for down the line.

The biggest mistake people make with trusts is they never do anything with them. In other words, people spend money to have an attorney help them set up a living trust, also referred to as a revocable trust, usually to avoid probate, but if you don’t transfer your home and other assets into the name of the trust, your kids will still have to go through probate.

Another mistake people make is thinking a will and a trust accomplish the same things. Not true. A properly written and signed will tells the world who you want your worldly possessions to go to upon your death. But, a probate court has to order this to happen or oversee who gets what and when. So, when you die, your will is presented to a probate court. That court oversees the transfer of assets from your estate to your heirs. The problem with probate is that going to court costs money and can be a lengthy process.

Having a will is helpful. We don’t want to discourage you from writing one. But when you set up a trust document and retitle your assets, your heirs can bypass probate court. In its basic form, a trust allows you to hold all of your assets in one place and name yourself the trustee and beneficiary of the trust. You can also name replacement trustees and beneficiaries for the trust.

Upon your death, the replacement trustee steps up to administer the trust and the replacement beneficiary automatically becomes the beneficiary of the trust’s assets. The trustee controls and handles the affairs of the trust and the beneficiary is now the owner of the trust — the person that benefits from the trust.

The problem is people generally purchase homes in their own names and must transfer the ownership of the home from their own names into the name of the trust. If they don’t take this step, the home remains owned in their own names and the home must go through probate even if they set up a trust.

Generally, when you set up a trust, the attorney that set it up will prepare a deed to transfer ownership of the home from your own name into the name of the trust. Sometimes that attorney will send you to a real estate attorney to take care of that transfer. In either case, once that deed is prepared and signed, it must get filed or recorded with the office that handles real estate documents where the home is located.

So, if you’ve taken all the steps to set up a trust and put your home into the name of the trust, you should be set. But what if you have a mortgage on the property? The lender that gave you the money to buy your home took a lien on your home using either a mortgage or trust deed. That document does not change and does not need to change. When you retitle the property, the mortgage remains in place. You shouldn’t have to do anything with the lender.

You might, however, want to talk to your homeowners insurance agent to make sure your home insurance is up to date. Your insurance policy should name you and your trust properly. When you do this, make sure there are no changes to your insurance coverage that would alter the coverage your mortgage lender requires you to carry on your home.

Finally, we talked about your trust in general terms. Did you sit down with your estate attorney to discuss your intentions and what terms should be included in your trust document? There are many types of trusts that can be used, depending on your particular situation. Revocable trusts are just the most basic (and typical) trusts that many people use.

But they won’t serve every need. For example, if your goal is tax planning, liability protection purposes, charitable purposes, spendthrift arrangements, or for a child with special needs, you’ll want to use different types of trusts. Or, if you want to protect minor children or have a vacation property you want to pass down before you die, there are specific trusts that can help you accomplish these goals.

That’s why you should talk to an estate attorney who concentrates their practice in the type of problems you’re trying to solve.

========

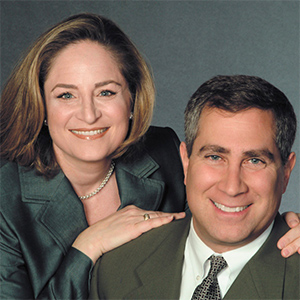

(Ilyce Glink is the author of “100 Questions Every First-Time Home Buyer Should Ask” (4th Edition). She is also the CEO of Best Money Moves, a financial wellness technology company. Samuel J. Tamkin is a Chicago-based real estate attorney. Contact Ilyce and Sam through her website, ThinkGlink.com.)

©2025 Ilyce R. Glink and Samuel J. Tamkin. Distributed by Tribune Content Agency, LLC.

Comments