Social Security Benefits Insight: Early Retirement Considerations

Published in BenefitsWise

Deciding when to retire is a crucial decision that has long-lasting implications on ones financial stability and lifestyle. While the full retirement age for Social Security is between 66 and 67, depending on the year of birth, individuals can opt to retire as early as 62. However, early retirement comes with its set of considerations and ramifications on Social Security benefits.

When individuals choose to retire early, they will receive benefits for a more extended period, but these benefits will be reduced. The reduction is a fraction of a percent for each month one claims benefits before reaching full retirement age. For instance, if one starts receiving benefits at 62, the amount could be reduced by about 25-30% compared to if they had waited until full retirement age.

This permanent reduction in benefits impacts the overall lifetime benefits one receives, especially considering the increases in life expectancy. While one receives smaller checks for a more extended period, the overall lifetime value might be less than if they had waited until full retirement age or delayed benefits even further, up to age 70.

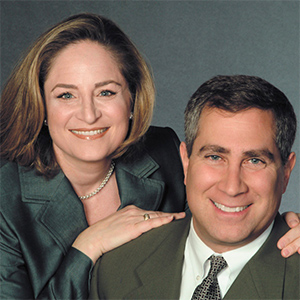

Another critical consideration is the impact on spousal benefits. When primary earners opt for early retirement, it also reduces the benefits that the spouse might receive, possibly affecting the overall financial stability of the household, especially if the spouse outlives the primary earner by several years.

Moreover, early retirement might affect ones ability to continue working. There are limits to how much one can earn while receiving Social Security benefits before reaching full retirement age. Earnings over the limit will result in a reduction in benefits, although these benefits are recalculated upon reaching full retirement age to account for months of benefits withheld.

Lastly, retiring early might mean that one has to wait to enroll in Medicare, unless they qualify for it due to disability, potentially leaving a gap in health insurance coverage. Health insurance costs and medical expenses during this period need to be factored into ones retirement planning.

Given these considerations, early retirement requires thoughtful planning and assessment of ones financial readiness, life expectancy, health, employment opportunities, and lifestyle preferences. It's essential to evaluate the immediate and long-term impacts of early retirement on Social Security benefits and make informed decisions that align with ones retirement goals and overall financial well-being.

In conclusion, while early retirement offers the allure of receiving benefits sooner, its imperative to weigh the benefits against the long-term implications carefully. Considering factors such as life expectancy, health, and financial stability can aid in making a decision that ensures a comfortable and secure retirement.

Note: These articles are not a substitute for professional financial or legal advice. Always consult professionals for your specific needs.

This article was generated by Open AI with human guidance and editing along the way.

Comments