US and Europe car markets 'at risk' amid tariffs and emission regs, Stellantis boss says

Published in Automotive News

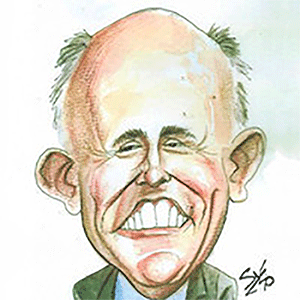

Stellantis NV Chairman John Elkann warned Tuesday that the American and European car markets are "being put at risk" by tariffs and stringent emissions regulations just as China rapidly pulls ahead.

"In Europe and the United States, policy and regulatory choices have put our industry under extreme pressure, while China is on another trajectory," Elkann said during the Jeep and Ram maker's annual general shareholders meeting in Amsterdam. "This year, the Chinese automobile market is set for the first time ever to be larger than the American and European markets combined."

The American and European markets are the automaker's largest. Elkann said the U.S. industry is currently "severely affected" by President Donald Trump's 25% tariffs on vehicle imports, and the chairman noted that Stellantis also is being hit with "compounding tariffs" on top of that — including 25% on steel and aluminum, and starting in early May, on auto parts.

The tariffs earlier this month caused Stellantis to temporarily pause major assembly plants in Canada and Mexico making popular Chrysler minivans and Jeep crossovers, while conducting temporary layoffs in the United States, as the automaker seeks clarity on how some of its imported vehicles will be charged. On Monday, Trump said he was considering providing tariff relief for automakers related to parts, but he didn't go into detail.

"We are encouraged by what President Trump indicated yesterday on tariffs for the car industry," Elkann said.

As for Europe, Elkann sharply criticized increasingly stringent emissions regulations being implemented across the region, which he argued creates an "unrealistic path to electrification, disconnected from market realities." He said the stricter rules have come just as some countries pulled back on EV incentives and support for charging infrastructure: "As a result, consumers are slow to transition to electric vehicles."

Stellantis net profit fell 70% in 2024 after a record high the prior year, with its margin falling to 5.5% after being in the double digits for several years amid a stretch of poor sales, as well as inventory buildups and production issues. Elkann acknowledged it "was not a good year," especially given many of the company's problems were its own doing.

Elkann has led the company on an interim basis after CEO Carlos Tavares departed in December, and he reiterated that hiring a replacement will be complete in the first half of this year.

At the annual general meeting Tuesday, shareholders approved a dividend payment to shareholders from its profits of .68 euro per common share, or 77 cents — a payout totaling about 2 billion euros, or more than $2.2 billion.

Also approved were two new Americans who will join the 11-member Stellantis board, with five others reelected to serve two-year terms. The addition of Alice Schroeder, a former Morgan Stanley managing director, and Daniel Ramot, who leads the public transportation and software company Via, shifts the board's membership slightly more toward North America, a region where the company has recently struggled. Currently most of the board's members are French and Italian nationals.

Shareholders also signed off on an updated compensation policy for the company's top executives, which includes the potential for larger performance incentive payouts. That's a move the board of directors believes will help attract the right CEO replacement for Tavares, who had already been among the highest-paid auto executives in recent years.

©2025 www.detroitnews.com. Visit at detroitnews.com. Distributed by Tribune Content Agency, LLC.

Comments