My Gig Life: 5 smart things you can do to improve your cash flow right now

Published in Lifestyles

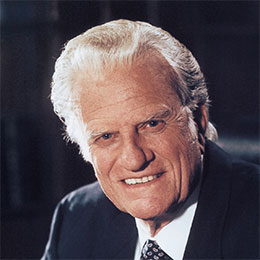

Let's cut to the chase. If you're reading this, you're probably juggling multiple gigs, watching every dollar, and wondering how to get ahead instead of just getting by. I've been writing about money for decades, and here's what I know: Gig workers who thrive don't just work harder—they work smarter.

The gig economy isn't going anywhere. In fact, it's exploding. But here's the thing most people don't tell you: the difference between gig workers who struggle and those who build real wealth isn't luck or timing. It's strategy.

Today, I'm sharing five moves that can transform your cash flow starting this week. These aren't pie-in-the-sky ideas—they're practical, proven strategies that real people use to turn their gig work into serious money.

1. Stack Your Income Streams Like a Pro

Relying on one gig is like putting all your eggs in one very fragile basket. The most successful gig workers I know have multiple income streams flowing at once.

Think about it this way: If you're driving for Uber, you're already in your car. Why not deliver food between rides? If you're freelance writing, why not offer social media management to the same clients? The key is finding gigs that complement each other instead of competing for your time. Working smarter not harder (which is part of the title to a book I wrote a number of years ago while consulting with a client).

Start by mapping out your current skills and schedule. Where are the gaps? What services could you add that use the same resources you're already investing? This isn't about working 24/7—it's about maximizing the return on the time and energy you're already spending.

2. Turn Your Knowledge Into Affiliate Income

This is where most gig workers miss a huge opportunity. You're already in the trenches, learning what works and what doesn't. That knowledge and those relationships you’ve built over the years, have value—and people will pay for it.

The beauty of affiliate marketing is that it scales. You do the work once—writing a blog post, creating a video, or even just having conversations—and you can earn from it repeatedly. Start small: Share what's working for you on social media, with friends, or in online communities. Be genuine about your experiences, and the money will follow.

3. Mine the Gold in Side-Hustle.com's 500+ Opportunities

Here's something that might surprise you: Most gig workers only scratch the surface of what's available. Sites like Sidehusl.com list over 500 different ways to earn money, but most people never look beyond the obvious options.

Set aside two hours this week to dig deep into these opportunities. Don't just look for more of what you're already doing—look for gaps in your income portfolio. Maybe you're great at graphic design but you've never considered creating digital products. Maybe you have organizational skills that could translate into virtual assistant work.

The opportunities are there, but they won't find you. You have to actively seek them out and match them to your unique combination of skills, interests and availability.

4. Think About What You're Good At, Then Find Your Gig Opportunity

This might sound obvious, but most people get it backward. They look for available gigs and then try to fit themselves into them. The smart approach? Start with your strengths and work outward.

Make a list of everything you're genuinely good at—not just your formal skills, but your natural abilities. Are you great at explaining complex things? There's a market for that. Do you have an eye for detail? Plenty of gigs need that. Are you naturally organized? Virtual assistance or project management could be your goldmine.

Once you know your strengths, research how those skills translate into gig opportunities. Often, the most profitable gigs are the ones that feel easiest to you because they leverage your natural abilities.

5. Build Your Emergency Fund While You Build Your Income

I know this all sounds great and doable. But, here's the reality check: Gig work is inherently unpredictable. The workers who thrive are the ones who prepare for that reality instead of hoping it won't affect them.

Every extra dollar you earn from these strategies should be split: some for immediate needs, some for growing your business, and some for your emergency fund. Even if it's just $20 a week, start building that cushion.

Why? Because when you have financial breathing room, you can be more selective about the gigs you take. You can invest in better equipment, training or marketing. You can turn down low-paying jobs and hold out for better ones. You can build side hustle skills that will last and will ultimately fund your retirement. Financial security gives you the freedom to be strategic instead of desperate.

The Bottom Line

The gig economy rewards people who treat it like a business, not a hobby. These five strategies aren't just about making more money—they're about building a sustainable, scalable approach to gig work that can actually create wealth over time.

The best part? You can start implementing these ideas today. Pick one strategy that resonates with you and commit to it for the next 30 days. Track your results. Then add another. Double down on your success and watch your track record of accomplishments grow.

Remember: Every successful gig worker started exactly where you are now. The difference is they took action on ideas like these instead of just reading about them.

Your financial future is waiting. What are you going to do about it?

____

Want more practical money advice? Follow my work for weekly insights on building wealth, no matter where you're starting from. Because everyone deserves financial freedom—but not everyone is willing to do what it takes to get there. And, be sure to visit my website, ThinkGlink.com.

____

©2025 Tribune Content Agency, LLC

Comments