Why more drivers are leaving the dealership with a lease and not a loan

Published in Slideshow World

Subscribe

Why more drivers are leaving the dealership with a lease and not a loan

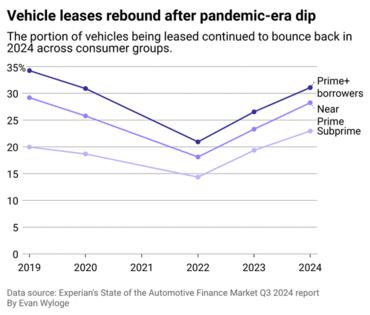

For many Americans, access to a personal vehicle is a necessity, but like most other consumer goods, the price of owning one has risen. Last year, car buyers sought to lease vehicles instead of obtaining traditional car loans, with the former option accounting for about 25% of new vehicle purchases, according to Experian's State of the Automotive Finance Market Q3 2024 report.

This continues a rising trend from 2023, when leases comprised approximately 20% of new vehicle purchases versus about 17% in 2022. This purchasing shift follows a drastic increase in vehicle loan interest rates, nearly doubling throughout 2022 after sitting at historic lows.

The debate about leasing or purchasing a car depends heavily on a consumer's situation and plans for the vehicle. Leasing can provide an attractive option to consumers with lower down and monthly payments while offering a commitment to shorter terms than a traditional automotive loan. Leasing can also grant consumers more immediate access to higher-end vehicles they would not usually be able to buy with the terms of a traditional loan, allowing them more flexibility in obtaining payments compatible with their finances. Since leased vehicles are only in a consumer's possession for a certain length of time, they can also save on maintenance costs over the vehicle's lifespan.

On the other hand, purchasing a car allows consumers to fully own a vehicle without the need to watch out for any mileage restrictions. Buyers also won't need to fret over potential additional costs for wear and tear beyond the typical scratch. Owners can also sell their vehicles or trade them for credit toward their next car purchase.

Buyers are only beginning to see a shift in car prices and interest rates, finally cooling off after going into post-COVID-19 pandemic overdrive. With vehicle prices and financing rates remaining relatively high, more people will likely consider leasing instead of buying.

The General used data from the consumer analytics firm Experian to illustrate how leasing has grown in popularity over the past two years and how much money leasing can save consumers each month.

Visit thestacker.com for similar lists and stories.

Consumers increasingly favor leasing amid elevated interest rates

Vehicle finance rates and the prevalence of leasing reached a historic low in 2022 after the economic disruption from the pandemic. As the Federal Reserve enacted several rate cuts between 2022 and 2024, vehicle financing rates rose, and the number of consumers seeking leases rebounded.

Finance rates for new and used vehicles increased, and the prevalence of leasing rose from prime to subprime borrowers, indicating an increased popularity of leasing among the buying public. Prime borrowers have good credit and are considered the least likely to default on loans; in contrast, subprime borrowers have a higher risk of nonpayment due to limited or damaged credit histories.

Monthly payments on leases also fell throughout 2024, making them more appealing to consumers attempting to offset higher monthly financing rates with lower monthly payments. Consumers are also looking to avoid being locked into longer-term loans by holding off on their next car purchases or opting for shorter-term financing with tolerable interest rates, which allow them more flexibility on buying their next vehicle and credit.

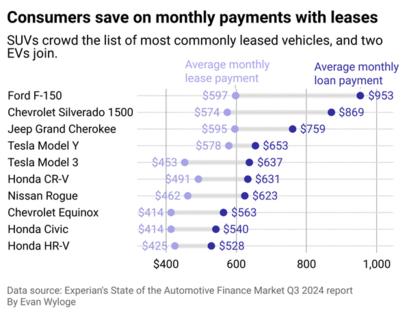

Monthly savings add up on lease payments compared to loans

Among the most commonly leased vehicles of 2024, consumers saved an average of approximately $148 per month. The actual dollar amount varied across cars, with the Tesla Model Y having an average savings of $75 and the Ford F-150 having an average monthly savings of $356. Differences can vary widely for vehicles that are not commonly leased.

The Honda CR-V was the most popularly leased vehicle of the year, with the Tesla Model Y, Jeep Grand Cherokee, Honda HR-V, and Chevrolet Equinox also ranking in the top 10, exhibiting a large shift for consumers toward SUV models, which accounted for over 61% of all newly financed vehicles in the third quarter of 2024.

The Chevrolet Silverado 1500 and Ford F-150 were also among the most popular vehicles to lease, which shows that consumers in need of pickup trucks can obtain access to the vehicles despite their high overall cost and financing rates. Electric vehicles were also popular to lease, with the Tesla Model Y and Model 3 among the top 10 most popular.

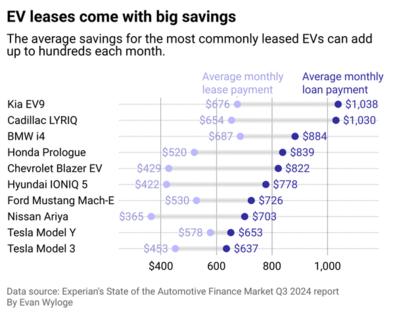

EV leases can save consumers even more

EV buyers saw even bigger savings on leases than purchases, with the average savings on an EV lease being $198. This was a $50 savings over the average monthly lease for gas vehicles. Since EVs usually have a higher average price overall, they tend to have higher monthly payments than leases.

Among the most commonly leased EVs, such as the Kia EV9, Cadillac Lyriq, Hyundai Ioniq 5, and Nissan Ariya, an average monthly lease payment was over $300 less than an average monthly payment on a loan. The Chevrolet Blazer EV saw one of the biggest differences, with an average monthly lease of only $429. In contrast, an average monthly loan payment was nearly double that, at $822, for an average monthly savings of $393. Meanwhile, the Tesla Model Y saw a much smaller difference, with an average savings of $75 per month.

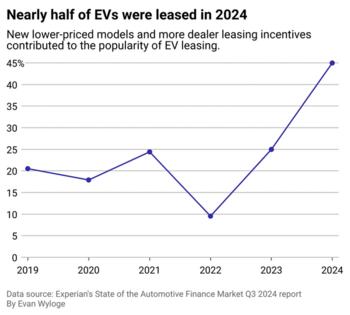

Leasing is especially attractive for EVs

EVs accounted for 17.3% of all new leases in 2024 and grew 30% compared to 2023. Nearly 45% of new EV transactions were leasing, a continued rise from just about 25% in 2023 and 10% in the third quarter of 2022.

According to TransUnion, numerous factors contributed to the increased popularity of EV leasing. The days of supply shortages of lithium batteries have passed, and inventory levels have stabilized at dealerships. More lower-priced models and new dealer leasing incentives contributed to this increase.

Additional incentives, such as tax credits from the Inflation Reduction Act of 2022 granted toward the lease of EVs in January 2023, also helped boost interest. Potential buyers can receive up to $7,500 in tax credits, which can be applied to the purchase of the vehicle for an even larger savings on the vehicle's overall price. According to Reuters, these credits may disappear in the Trump administration as part of a broader tax reform program, which may put the EV's popularity in contention.

Story editing by Carren Jao. Copy editing by Paris Close.

This story originally appeared on The General and was produced and distributed in partnership with Stacker Studio.

Comments