Oz offers recourse if Congress can't quickly resolve subsidies

Published in News & Features

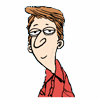

WASHINGTON — The Trump administration is discussing options to ease health insurance sign-ups if Congress doesn’t soon reach an agreement on extending health care premium tax credits, Centers for Medicare and Medicaid Services Administrator Mehmet Oz said Tuesday.

If Congress extends the credits after the Nov. 1 start of open enrollment, the administration could offer consumers a special enrollment period to sign up for health insurance coverage on the marketplace or help insurers issue rebates to enrollees, among other options, Oz explained.

The expanded tax credits, also described as health care subsidies, expire on Dec. 31. Insurers say it will be extremely difficult for them to adjust premiums for the 2026 plan year if Congress doesn’t act to extend them before the end of the month.

While Oz said that he agrees with House and Senate GOP leadership that any short-term government funding bill should not include health care subsidies, he said it’s important the administration have a plan in place should Congress extend the subsidies between Oct. 1 and the end of the calendar year.

“We’ve been having ongoing discussions. Even last night — had a big discussion with a lot of the folks who are involved in making this decision,” Oz said in a hallway interview at the Capitol, when asked about ways the administration could step in. “There are a lot of ideas that could work,” including the government-run special enrollment period or premium rebates, among other things.

Insurers and health policy experts are skeptical that the process will be smooth.

The next opportunity for lawmakers to vote on an extension would likely be in November or December, after enrollment for the 2026 plan year has already begun.

“The damage will be done from an enrollment perspective when people see the sticker,” Alliance of Community Health Plans senior vice president of federal affairs Dan Jones said. “People will walk away.”

Last-minute scramble

The 2010 health care law created tax credits for individuals at or below 400% of the federal poverty level. Democrats lifted that cap during the pandemic to make subsidies more generous for all income levels. It’s these expanded subsidies that will expire Dec. 31 without action from Congress.

Health insurers typically send final notices for 2026 premiums out by the end of September ahead of the Nov. 1 deadline. This year, the Centers for Medicare and Medicaid Services is requiring plans to submit final rates by Friday.

Once insurers set premiums and send out final rate notices, they typically do not change rates ahead of open enrollment. A last-minute scramble is possible, though it would be chaotic, experts say.

Jones said the community health plans he works with are striving to make it work regardless.

Heather Foster, vice president for marketplace policy at the Association for Community Affiliated Plans, said “there’s a real burden operationally” for plans if they must refile rates after Nov. 1. Depending on policy, plans would not only need to recalculate their rates, they’d also need to redo their marketing and communications, address actuarial assumption and retrain their customer service team — all of which is expensive.

The expanded subsidies lowered health care costs for millions of Americans who receive subsidies on the individual market. If they expire, monthly payments could rise by up to 50%.

Some states asked insurers to submit two sets of rate filings for 2026 — one if Congress extends tax credits and one if they do not. Across the board, those rates are lower if Congress extends tax credits.

The Colorado legislature passed legislation to cushion the impact by setting up a $100 million state-backed fund to limit premium hikes. After Gov. Jared Polis signed the bill on Aug. 28, insurers in the state lowered marketplace premiums for the coming year. The law only takes effect if Congress does not extend the tax credits by the end of the year.

But most states have not set up such contingencies, and many enrollees could be in for a sticker shock when Open Enrollment begins on Nov. 1.

Another step the administration could take to lower costs is “premium holidays,” in which the premiums are suspended for a time, explained Sabrina Corlette, co-director of the Center on Health Insurance Reforms at Georgetown University.

But rebates and premium holidays are difficult for insurers to pull off, can create confusion among consumers and don’t do anything to lessen the shock of a higher monthly payment.

Even a special enrollment period for consumers to sign up for coverage could sow confusion.

“Each delay it gets harder and harder and each delay you lose more and more enrollees,” Foster said. “If Congress acts after Dec. 31, [insurance] plans can change things, but it will be an absolute mess.”

©2025 CQ-Roll Call, Inc., All Rights Reserved. Visit cqrollcall.com. Distributed by Tribune Content Agency, LLC.

Comments