Boeing on track to generate billions in cash next year

Published in Business News

Boeing Co. expects to generate cash again in 2026, a significant reversal in the planemaker’s finances as it prepares to boost monthly production rates of its passenger aircraft.

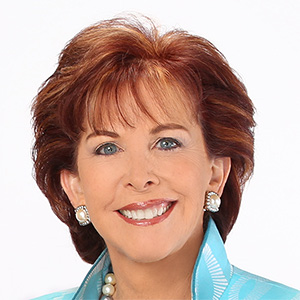

The U.S. company expects positive free cash flow to reach the “low-single digits” billions of dollars next year, reversing the $2 billion cash burn seen for 2025, said Boeing Chief Financial Officer Jay Malave, in his first solo presentation at an investor conference since taking over the post in August.

The assurances propelled Boeing’s shares, with the stock advancing as much as 9.2%, the most since April. Malave’s comments provided the first detailed look at the planemaker’s cash projections for 2026, a year when Boeing’s comeback should gain momentum if jet deliveries keep rising while factories and the supply chain stabilize.

Longer term, the company still expects to eventually reach the $10 billion cash-generation target outlined by the previous management team, Malave said. That goal, initially set for 2025, had been pushed back repeatedly as Boeing battled through a series of crises.

“There’s just no reason why we can’t get to that once we get to these higher rates on the aircraft,” Malave told a UBS conference. “I’m very comfortable saying that we can absolutely deliver $10 billion.”

Malave’s comments shored up confidence in Boeing, particularly among investors nervous about the planemaker’s comeback after it reported a $4.9 billion charge for the latest delay to its 777X jetliner in October, said George Ferguson, analyst with Bloomberg Intelligence.

While Boeing had previously predicted it’s cash generation would vastly improve next year, Malave’s comments carried some weight as an outsider who joined Boeing from defense rival Lockheed Martin Corp, Ferguson said.

“Fleshing out for next year is a nice confirmation” that Boeing’s operations remain on-track, he said. “And Airbus’s issues this week are a reminder that it’s not a one-horse race.”

The CFO cited a steadily improving production cadence in Boeing’s factories, especially for its 737 Max and 787 Dreamliner jets, and the reduction of its inventory of undelivered aircraft as reasons for optimism, alongside improving profitability at its defense division and steady growth for its services operations.

Analysts expect Boeing to generate $2.46 billion in free cash flow next year, according to estimates compiled by Bloomberg. They’ve pared their free cash flow predictions by more than half since mid-July on the slower-than-expected certification of the 777X, pushing its largest in-production jet more than seven years behind schedule. Malave said the delay would bring about $2 billion of “pressure” to next year’s cash generation.

The company also expects to make a large payment to the U.S. Justice Department next year to resolve a case stemming from two fatal crashes of its 737 Max. Malave also cautioned that the largest 737 model, the Max 10, likely won’t be certified for commercial service until later in 2026, pushing some deliveries into 2027.

Boeing’s free cash flow hasn’t been positive on an annual basis since 2023. After years of turmoil, the planemaker is working to whittle down its debt load and invest in projects that will secure its future.

Adding urgency to the turnaround is the fact that the company faces $8 billion in debt payments next year, and plans to quickly pay down another $3 billion in Spirit AeroSystems Holdings Inc. obligations once the acquisition of the supplier closes. Approval of the complex deal reuniting Boeing with its former subsidiary is in the latter stages, Malave said.

Boeing lost a cumulative $39 billion during the first half of this decade, including $13.1 billion last year as it faced a crippling strike and a near-catastrophe that sparked federal investigations and a leadership shake-up.

©2025 Bloomberg L.P. Visit bloomberg.com. Distributed by Tribune Content Agency, LLC.

Comments