California insurers to charge homeowners for FAIR Plan bailout after LA wildfires

Published in Business News

Homeowners across California will soon see a new charge on their monthly insurance bills to help pay claims arising from this year’s devastating Los Angeles wildfires.

Most of the temporary fees imposed by the state’s largest insurance companies will be relatively small, a few dollars per month, averaging around $50 to $60 in total over two years, according to a review of regulatory filings by the Bay Area News Group.

The surcharges, which are expected to affect the majority of the state’s homeowners, are scheduled to take effect in the coming months. Although the charges, calculated annually, generally average around 1% to 2% of homeowners’ premiums, policyholders may be hit with higher fees if they have more expensive plans.

While the charges are unlikely to cause serious financial hardship for most homeowners, they’ve raised concerns that future catastrophic wildfires could lead to even higher fees, as policyholders statewide are already being hit with steep rate hikes and some have been dropped from their plans.

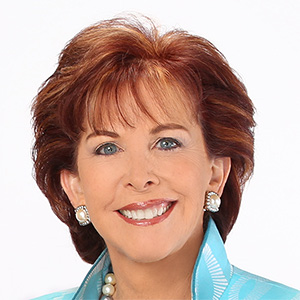

“If these surcharges stand, it’s almost certain that consumers will see future surcharges on their bills,” said Carmen Balber, executive director of Los Angeles-based Consumer Watchdog, which has sued to halt the fees.

The charges stem from a mandated $1 billion bailout by insurance companies of the state’s last-resort insurance program, known as the FAIR Plan, after it ran out of money to cover roughly $4 billion in claims from victims of the Los Angeles wildfires, which damaged or destroyed nearly 13,000 homes.

Under recently updated regulations by state regulators, insurers can recoup up to half of the bailout cost directly from their policyholders. The amount each insurer must pay is determined by its market share of premiums in the state. The state insurance department has already approved the individual surcharges proposed by many insurers.

Homeowners with a standard policy through State Farm — the state’s largest insurer, with more than a million homeowner plans — will see a total fee averaging $57.70, with charges averaging 1.13% over two annual renewal periods, according to regulatory filings. Condo owners will be billed an average of $25.10, at a 2.25% rate over just one year. The charges, spread across policyholders’ monthly payments, are set to start on Dec. 1.

Farmers, the state’s second-largest homeowner insurer, will levy an average charge of $51.60, at 1.02% over a two-year period. For condo owners, the fee will be $26.40 at the same rate. Both charges are scheduled to start on Jan. 21.

CSAA Insurance customers will see an average charge of $57.60, at 1.17% over two years. Condo owners’ fee will be $20.80 at the same rate. The charges are set to begin on Dec 1.

Allstate customers will see an average charge of $48.80, at 1.02% over a two-year period. For condo owners, the fee will be $25.40 at the same rate. The charges are planned to start on March 21.

While all licensed property insurers are required to pay into the FAIR Plan bailout, it’s up to individual insurers to determine whether to bill policyholders.

In response to a question about why the charges are necessary, State Farm cited a news release from last month that said the fees will allow the company to offset costs of its emergency payments to the FAIR Plan and help State Farm “continue to serve California customers.” Farmers declined to provide an explanation for the charges. In a statement, CSAA said the fees will ensure the “continued availability of insurance in the state.” Allstate did not respond to a request for comment.

In April, Consumer Watchdog sued the California Department of Insurance to halt the charges, contending they violated state law. The lawsuit is ongoing, and the group ultimately hopes to secure a refund for homeowners, Balber said. The insurance department did not respond to a request for comment. But in a statement earlier this year, it accused Consumer Watchdog of seeking to profit from the lawsuit and “create chaos in an already complex situation.”

The FAIR Plan is a state-created program backed by private insurers that is required to provide coverage for homeowners and businesses whose properties are deemed too risky by traditional carriers. The plan offers only bare-bones fire protection at a much higher premium than standard insurance options. FAIR Plan policyholders will not see an additional fee related to the bailout.

As the number of policyholders on the FAIR Plan doubled over the past two years to more than 640,000, plan officials had warned that a surge in claims triggered by a catastrophic wildfire could propel the program toward insolvency, risking coverage for those in fire-prone parts of the state.

Following the Los Angeles fires, the insurance industry has argued the homeowner-funded bailout is necessary to keep the FAIR Plan afloat while preventing traditional providers from having to raise rates even higher. Industry officials blame the state’s tightly regulated insurance market for forcing homeowners onto the FAIR Plan and jeopardizing its financial stability.

“Why did the state allow over a decade of inadequate rates, such that the market began to decay?” asked Rex Frazier, president of the Personal Insurance Federation of California, an industry group.

In California, the average annual cost of a basic home insurance plan is $1,632 as of November, below the national average of $2,408, according to Bankrate.com, a personal finance site. However, homeowners in fire-prone areas often need to buy additional protection.

Late last year, state regulators finalized reforms that allow insurers to raise rates based on the threat of climate change — a long-standing industry demand — in exchange for expanding coverage in parts of the state with the greatest wildfire risk. The industry is still in the process of phasing in the changes, and they have yet to provide meaningful relief for homeowners.

©#YR@ MediaNews Group, Inc. Visit at mercurynews.com. Distributed by Tribune Content Agency, LLC.

Comments