US inflation tops forecasts, bolstering case for Fed to hold

Published in Business News

U.S. inflation picked up broadly at the start of the year, further undercutting chances of multiple Federal Reserve interest-rate cuts this year at the same time the Trump administration presses forward with tariffs.

The monthly consumer price index rose in January by the most since August 2023, led by a range of household expenses like groceries and gas, as well as housing costs. Excluding often-volatile food and energy costs, the so-called core CPI climbed 0.4%, more than forecast, fueled by car insurance, airfares and a record monthly increase in the cost of prescription drugs.

Inflation tends to come in higher in January, because many companies choose the start of the year to hike prices and fees. That pattern has been been exacerbated in the post-pandemic era, and several forecasters suggested that the jump in price growth last month won’t be repeated going forward.

Still, Wednesday’s report from the Bureau of Labor Statistics serves as further evidence that inflation progress has at least stalled — if not in danger of being reversed. Combined with a solid labor market, it will likely keep the Fed on hold for the foreseeable future. Policymakers are also awaiting further clarity on Trump’s policies, particularly tariffs, which are already causing consumer inflation expectations to rise.

The S&P 500 fell while Treasury yields and the dollar spiked. Interest rate swaps showed traders are only expecting one quarter-point Fed rate cut this year. Before the CPI report, traders were leaning toward two cuts.

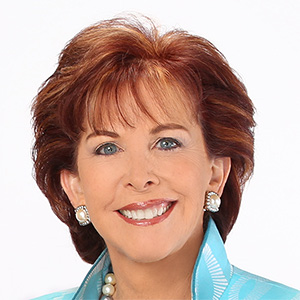

“We saw strength across the board — whether you’re looking at energy, food, within core components — and so I think it points to a price environment that still remains difficult as far as the Fed is concerned,” said Sarah House, a senior economist at Wells Fargo & Co. “So for how long you expected the Fed to be on hold going into this report, I think this only lengthens that time frame.”

Here are five key takeaways from Bloomberg’s TOPLive blog

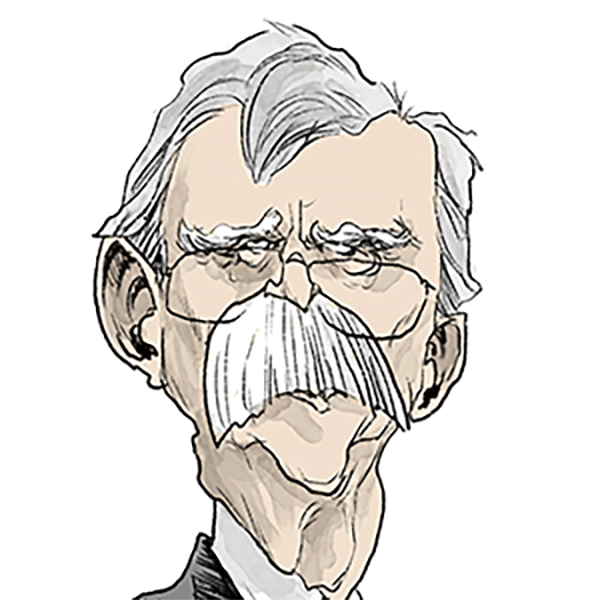

Fed Chair Jerome Powell, speaking before the House Wednesday, said the latest consumer price data show that while the central bank has made substantial progress toward taming inflation, there is still more work to do.

“I would say we’re close, but not there on inflation,” Powell told the House Financial Services Committee in response to a question on the second day of his semi-annual testimony to Congress.

Earlier Wednesday, Trump again called for lower interest rates and later suggested the inflation numbers were due to his predecessor, President Joe Biden.

The January increase in the CPI was led by grocery prices, with two-thirds of that advance due to higher egg prices in the wake of a deadly bird flu outbreak. The more-than 15% jump was the largest since June 2015. Costs of hotel stays and used cars also climbed, possibly in the aftermath of severe wildfires in Los Angeles.

The report incorporated new weights for the consumer basket to try to more accurately capture Americans’ spending habits, which resulted in minimal revisions to the CPI last year.

Seasonal adjustments to January data were also minimal, and failed to offset the turn-of-the-year price hikes. As a result, “the sharp increase in the core CPI is less alarming than it first appears,” Sam Tombs, chief U.S. Economist at Pantheon Macroeconomics, said in a note. “We recommend waiting for February’s data, when the new seasonal factors look set to dampen the seasonally adjusted index more than in previous years, before judging how the underlying trend has evolved.”

What Bloomberg Economics Says...

“January’s CPI report showed surprisingly fast gains in the headline and core CPI indexes, but we think that’s mostly due to residual seasonality — the ‘January effect’ — limiting the signal from the hot print. When the seasonal-adjustment process doesn’t adequately account for the typical acceleration to start the year as firms reset prices, the result is a stronger-than-normal seasonally adjusted print.”

— Anna Wong and Stuart Paul. To read the full note, click here

Shelter prices, the largest category within services, advanced 0.4% in January, accounted for nearly 30% of the advance in the overall CPI. Owners’ equivalent rent and rent of primary residence — subsets of shelter — both rose 0.3%.

Excluding housing and energy, service prices jumped 0.8%, the most in a year, according to Bloomberg calculations. While central bankers have stressed the importance of looking at such a metric when assessing the overall inflation trajectory, they compute it based on a separate index.

That measure — known as the personal consumption expenditures price index — doesn’t put as much weight on shelter as the CPI, which helps explain why it’s trending closer to the Fed’s 2% target. A government report on producer prices due Thursday will offer insights on additional categories that feed directly into the PCE, which is due later this month.

Goods costs excluding food and energy rose by the most since May 2023. However, when removing used cars, the index was little changed.

Policymakers also pay close attention to wage growth, as it can help inform expectations for consumer spending — the main engine of the economy. A separate report Wednesday that combines the inflation figures with recent wage data showed real hourly earnings grew 1% from a year ago.

—With assistance from Chris Middleton, Matthew Boesler, Ye Xie and Reade Pickert.

(Adds Powell’s comments.)

©2025 Bloomberg L.P. Visit bloomberg.com. Distributed by Tribune Content Agency, LLC.

Comments