Don't Just Sit There. Retire.

You can see it. You can taste it. You can sit it on your lap and tickle its toes.

Retirement! Sweet retirement!

Here's the plan -- you work hard today, so tomorrow you can play. Of course, it's a tomorrow that can be 10, 20 or 40 years in the future, but it really doesn't matter. Work your fingers to the bone. Sacrifice dreams, ignore friends, avoid family, go as hard and as fast as you can go until you cross the finish line at 65, at which point you skid to a stop and start living the YOLO lifestyle you've always wanted.

The 65-year retirement date is arbitrary, admittedly. And there are risks. Everyone's heard about a 65-year-old striver who retired on Friday and died on Saturday. Not to mention all the good folks who never make it to 65 at all. It's just the way it is.

Except for some people, the way it is -- isn't.

Or so I learned in "Meet the 20-Somethings Taking Mini-Retirements," a recent article in New York Magazine by Charlotte Cowles.

"Instead of waiting until you're 60 or 70 to travel or try to indulge in hobbies," says a London-based engineer in her 20s," you do them while you have your youth, your energy, your health, and you dot them around your life."

Now, some people will read this as the kind of ageism that makes Gen-Z'ers so annoying, as if anyone over 65 would not be able to indulge in travel or hobbies. As an over-65 person, I still enjoy my travels, especially the exciting bathroom trips I make three or five times a night, or the head-snapping race back home every time I have to check if I really did lock the door or turn off the gas. (On the other hand, I must acknowledge that my own hobby could hold risks for an oldster with minimal energy and wavering health, but isn't that exactly what draws danger-seekers to whittling?)

While mini-retirements well before 65 do sound attractive, there could be financial implications. As Cowles writes, "What about health insurance? Student loan payments? Rent? The ability to save for your actual retirement down the road?"

To which I would add, what about your manager using the time you are on one of your mini-retirements to replace you with an AI chatbot? Chatbots never retire. They just hallucinate away.

Another problem that comes with the mini-retirement concept occurs when you decide to retire from your retirement and come back to work. You will need to explain the adult gap years on your resume. It may be a reach for a hiring manager who has logged decades at their desk to understand why you couldn't hack it for more than six months.

"I'm not saying you're a dope for working," you say, "but I'm a sensitive flower and I need to open my pedals to the sun."

Well, it could work.

There are some jobs in which mini-retirements are built into the job description. Grade school teachers get summers off. College professors get yearlong sabbaticals. The Bible advised farmers to take every seventh year off to let their land recover. Shouldn't an IT worker get every third year off to let their brain recover? The Bible doesn't answer this question, but maybe your employee handbook will.

Frankly, the best time to implement a mini-retirement occurs the minute you have nabbed a great new job. That's when you say, "I accept your offer. I'll start in six months, maybe seven. So hold that job and I'll show up, eventually."

Think it won't work? Remember -- you'll never be valued more than on the day you get a job offer, especially considering how the company's view of your abilities is sure to disintegrate once you actually start work.

Besides, who's to say the hiring manager won't be proud when they learn that their new hire will not be at their desk, but following the sun from Tahiti to Timbuktu, scampering up Everest or achieving a place in the Guinness World Records book for the longest uninterrupted nap in a backyard hammock?

In the end, only you can decide if the emotional rewards are worth the financial risks of a nontraditional, mini-retirement work style.

"You don't want to YOLO-spend your way through life," one Gen Z'er admitted. "But you also have to accept the reality that you're going to die someday, and you can't take your money with you."

That's true, but you can take your credit cards.

========

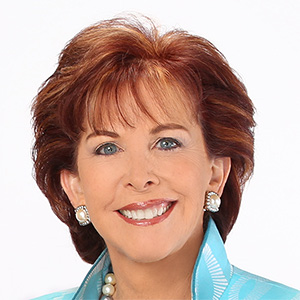

Bob Goldman was an advertising executive at a Fortune 500 company. He offers a virtual shoulder to cry on at bob@bgplanning.com. To find out more about Bob Goldman and read features by other Creators Syndicate writers and cartoonists, visit the Creators Syndicate website at www.creators.com.

Copyright 2024 Creators Syndicate, Inc.

Comments